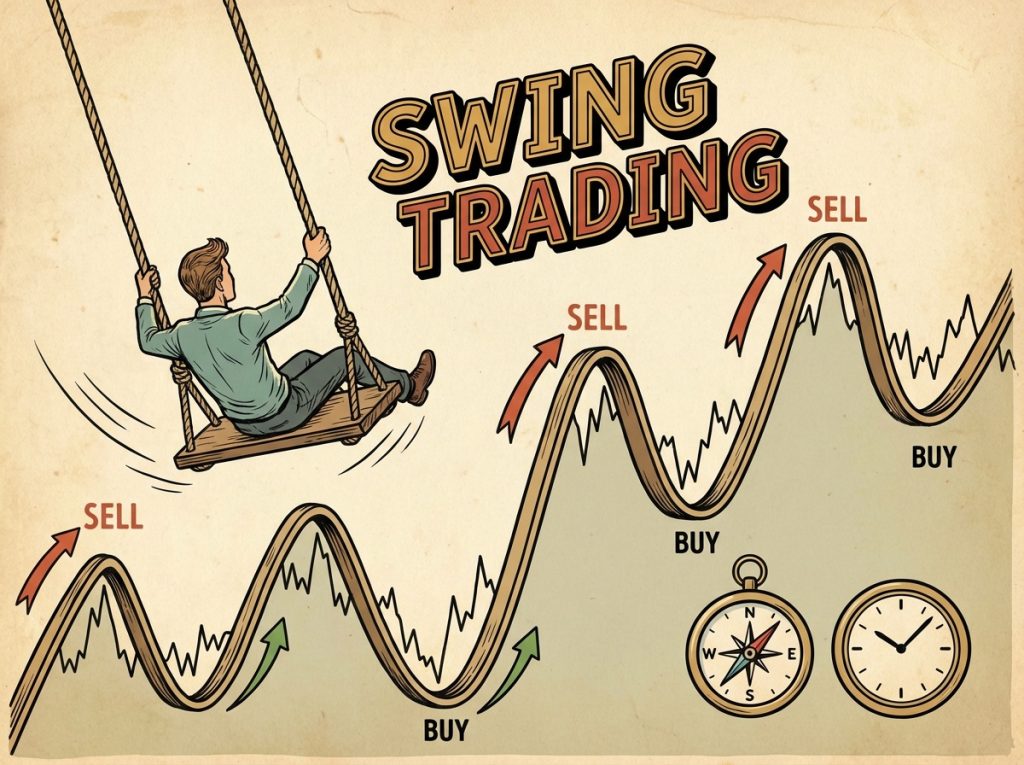

Swing trading with Contracts for Difference (CFDs) is a common active approach that sits between intraday work and longer-term investing: positions are held for several days to a few weeks, with the trader trying to capture intermediate moves caused by momentum, mean reversion, or event-driven reactions.

CFDs make swing trading pretty handy, you can get leverage on stocks, indices, commodities, and forex without actually owning anything, plus you can go short or long, and trades happen fast. But all that convenience comes with a price tag and some odd rules you’ll want to get familiar with. If you want your swing trading to actually work, and not just give you a wild ride, you need to understand those costs and how things run behind the scenes.

I will focus on Swing Trading CFDs. If you want to know more about Swing Trading in general then we recommend that you visit our website, our page about Swing Trading, or the website SwingTrading.

At its core swing trading CFDs trades on an expectation that a market will move a useful distance within a medium time window. That expectation must exceed the friction created by spreads, overnight financing, commissions and slippage. Unlike buy-and-hold equity positions where dividends and long-term capital growth matter more than overnight finance, CFD swing trades must overcome a repeating cost structure: each night a financed CFD position typically incurs a financing charge (or receives a financing credit in rare short-rate scenarios), and those charges compound the longer the trade is held. The trader therefore needs a sufficiently robust signal, price momentum that persists, a reversion that is likely and timely, or a known event with asymmetric follow-through, to justify the expected holding cost. In practice this means the edge for a CFD swing strategy must be durable enough to let winners more than pay for both the explicit trading fees and the implicit financing drag.

CFDs are available on many asset classes, but not all instruments are equal for swing trading. Major indices and liquid blue-chip stocks typically have tight spreads and deep liquidity, which reduces round-trip cost and the chance of outsized slippage when you enter or exit. Thinly traded single names, exotic commodities, or small FX crosses can look attractive in backtests but often show poor execution in real money: sporadic spikes, wide weekend gaps, and asymmetric order fills become the drag that kills performance. Another important mechanical detail is how your broker implements corporate actions and dividends on CFDs: long CFD positions are usually credited with a dividend adjustment and shorts are debited, but timing and tax treatment varies by provider. If a swing plan hinges on dividend capture or near-ex-div dates you must verify the broker’s precise handling in writing before committing capital.

Leverage is the defining operational parameter of CFDs. Used sensibly, it lets you express a meaningful directional view with less capital; misused, it converts a modest loss into rapid account depletion. Swing traders should fix absolute risk per trade in currency terms rather than as a percentage of a tiny balance, because percent-of-small-balance rules encourage oversized bets that ruin the account on a single adverse move. Translate your stop distance into dollars at the position size you will run and ensure that the sum of open exposures plus worst-case intraday moves comfortably fits available margin even after overnight funding. Understand margin call mechanics and the broker’s liquidation waterfall: some firms liquidate aggressively at a maintenance margin threshold rather than letting a trader address the shortfall, and in fast gap events the executed liquidation price can be materially worse than the margin call trigger shown on a platform.

Stop placement is both art and craft for swing traders. Stops should reflect market structure and volatility, not arbitrary percent rules. Many traders use an ATR-based stop or place stops beyond nearby technical structure, swing low, recent consolidation, volatility band, so that normal price noise does not prematurely close a valid trade. Use limit orders for planned entries where practical and market or stop-limit orders when speed matters; know how your broker treats stop orders during low liquidity or halts because “stop becomes market” semantics differ across providers. Consider staging entries (pyramid or scaled entries) to reduce the initial slippage burden and to improve average entry, but be disciplined about the total risk budget for the full intended size rather than treating each tranche independently. For exits, combine fixed target levels with a trailing stop so winners compound while risk is controlled, and be explicit about what you do if price revisits your entry region, will you add, exit fully, or halve the position?

A distinguishing operational variable for CFD swing trading is the nightly financing charge. Brokers compute financing differently: some charge a reference interbank rate plus a markup, others apply a fixed daily fee; some instruments have special funding rules. Financing can convert a mechanically profitable gross strategy into a net losing one if the holding horizon is long relative to the expected move. Measure expected financing cost against expected net move per day for your strategy: short expiry swing setups that resolve quickly are less exposed to carry, while multi-week trades must justify financing by larger expected price movement or by structural asymmetry such as carry or anticipated corporate actions. Don’t ignore spread: even a modest wide spread on entry and exit compounds over many small trades and often dwarfs the theoretical edge in high-turnover swing approaches.

Swing trades are vulnerable to scheduled and unscheduled events. Earnings, central bank decisions, economic releases and industry headlines can cause overnight gaps that bypass your stop and create larger-than-expected losses. A defensive practice is to identify the event calendar for instruments you trade and have explicit rules about holding positions through major scheduled events. Some swing systems avoid holding across earnings for single stocks; others reduce size or tighten stops ahead of known macro releases. If you do trade through events, size conservatively and consider protective hedges, for example a short-dated option to cap tail risk if the instrument and market permit, but understand the cost of such hedges and how they interact with CFDs’ financing mechanics.

A common mistake is treating several CFD positions as independent when they are strongly correlated. Holding multiple longs in the same sector or index futures and single stock CFDs that co-move increases portfolio volatility and the chance of contemporaneous margin pressure. Construct your swing book with an eye to correlation and scenario risk: combine exposures that reduce worst-case drawdown rather than simply increasing gross exposure. Use risk budgeting: allocate a maximum allowable drawdown per instrument and a combined portfolio stop that triggers a reassessment, and maintain cash or low-risk buffers to meet potential margin requirements without forced selling.

Backtesting is necessary but insufficient. Historical simulations must include realistic transaction costs, spreads, financing and the distribution of overnight gaps. Many strategies that look attractive in gross return fail under realistic cost assumptions. Forward testing on a funded micro account is essential because demo accounts often give idealised fills, ignore queueing effects, and do not reproduce the broker’s live funding or withdrawal friction. Run a staged approach: backtest with conservative assumptions, forward test on a small live account with the exact broker and account type you plan to use, measure realized slippage and finance charges over a few dozen trades that cover different market conditions, then scale only if the measured real-world edge remains.

Not all CFD providers are equal for swing trading. Prioritise transparent pricing, consistent spreads at the trade sizes you use, robust stop execution logic, clear documentation of overnight financing and dividend adjustments, and reliable withdrawal mechanics. Platform stability matters: outages in the middle of an adverse move can be catastrophic whether they stem from the broker or from your local connectivity. For algorithmic or partially automated swing systems evaluate the broker’s API stability, rate limits and historical latency. Prefer brokers that publish execution and routing policies and that are regulated in a jurisdiction with practical complaint and dispute channels; if a broker refuses to provide the entity name that will hold your funds, treat that as a disqualifier.